Designing for Risk: Climate Adaptation as Investable Infrastructure

Climate-responsive design focuses on carbon accounting, but America's climate reality arrives as increased flooding, windstorms, heat domes, wildfires, and polar vortex. This physical reckoning demands more than emissions reduction. It requires reimagining adaptation as investable infrastructure, shifting from reactive disaster spending to proactive resilience capitalism.

Climate adaptation defies traditional financing orthodoxy. Public-private infrastructure partnerships expect revenue-generating assets: toll roads, power plants, water utilities. Restored wetlands don't invoice for flood protection. Urban forests and green corridors don't bill for cooling services or charge admission for biodiversity preservation. This revenue invisibility has trapped adaptation in perpetual underfunding, relegated to grant dependency and political whim.

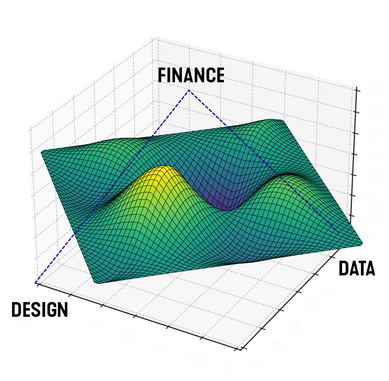

Breaking this impasse requires a new integration between technical professionals and investors: a framework we’re calling the Design–Data–Finance Triad. The triad converts climate-risk management into bankable projects by aligning design performance with investor metrics, financial models and governance structures. SmithGroup’s use of advanced risk modeling – including insights from global reinsurer Swiss Re’s Risk Data & Services (RDS) – along with our pioneering campus-scale initiatives demonstrate how this approach could make climate adaptation an investment-grade asset class.

Adaptation Is Infrastructure—But We're Not Funding It That Way

Globally, we're not meeting adaptation finance goals. The Organization for Economic Co-operation and Development calls for developed countries to double adaptation financing by 2025, but delivery mechanisms remain fragmented. While the Inflation Reduction Act and Bipartisan Infrastructure Law represent historic opportunities, adaptation remains underrepresented in funding pipelines — especially where projects lack clear cost-benefit frameworks.

What's missing is bankability. Infrastructure projects become bankable when investors can accurately assess risk, return, and resilience. Adaptation is often excluded because benefits are harder to quantify, risk data is incomplete, and performance metrics are inconsistent. But this is changing rapidly - and could go even faster with the opportunities offered through parametric design and analysis.

The triad presents an opportunity to connect the dots between risk, parametric performance and project economics.

The Design–Data–Finance Triad: Making Adaptation Bankable

The triad rests on three pillars:

- Design: Architecture and engineering firms model and manage climate risk through physical systems: buildings, energy networks, mobility corridors, green infrastructure, etc.

- Data: High-integrity risk metrics like Swiss Re's RDS provide science-informed insights of environmental hazards, including flood exposure and biodiversity loss.

- Finance: By integrating risk data early in project development, A&E firms like SmithGroup can cost project performance accurately and signal design alignment to private investors.

This triad enables de-risking design from the start. It embeds resilience and sustainability directly into project costs as standard practice, not add-ons.

A New Model for Risk-Led Design

The use of Swiss Re's RDS helps SmithGroup provide natural catastrophe modeling, with data offering localized risk profiles across the U.S. — including areas where traditional datasets may be limited or less granular. SmithGroup applies these insights to campus, city, and waterfront planning—translating flood, heat, and storm exposure into adaptive designs and budget forecasts.

This matters because risk becomes design-ready through precise, localized choices that strive to preserve ecological value. Sustainability gets priced in with credible risk projections, making green building costs quantifiable and defensible to funders and insurers.

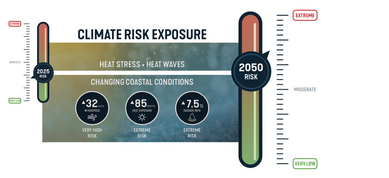

Example of a future climate risk exposure analysis that was developed using Swiss Re's Risk Data & Services.

Pricing Risk into Design: How Campuses Are Leading

University campuses have become sophisticated climate adaptation laboratories using the design–data–finance approach:

University of Texas at Arlington (UTA): UTA's Energy & Emissions Plan (developed in partnership with SmithGroup) provides investment-ready energy strategies with emissions impacts, cost estimates, and implementation roadmaps. The plan translates sustainability into hard numbers through performance metrics related to energy efficiency gains, making it both environmentally sound and fundable.

Indiana University Bloomington: IU's Climate Action Plan aligns capital investments with campus-wide emissions reductions and resilience measures. It models different implementation pathways with associated costs and carbon reductions, creating transparent decision-making tools that attract outside capital.

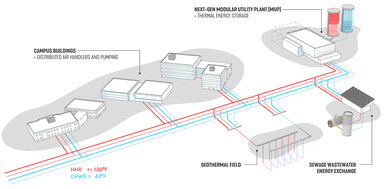

University of California, Merced: UC Merced's microgrid expansion demonstrates how energy infrastructure can be both adaptive and bankable. Designed to reduce peak demand, improve resilience, and integrate renewables, it's priced with capital, operations, and avoided-loss estimates—a climate adaptation asset designed for long-term financial performance.

These projects share something powerful. They don't just articulate climate goals, they price them – proving performance-based design can align directly to performance-based financing.

From PPPs to RDPs: Closing the Bankability Gap

Traditional Public–Private Partnerships (PPPs) struggle to fund adaptation projects because their value is measured in avoided losses rather than revenue streams. Resilience Design Partnerships (RDPs) reframe this by creating a complete bankability profile — integrating risk modeling, liability allocation and benefit flows into the design process from day one. Instead of relying solely on user fees or grants, RDPs quantify avoided disaster losses, lower insurance premiums and long-term operational savings as monetizable outcomes. The inclusion of governance mechanisms like performance guarantees, insurance-backed risk transfer and step-in rights gives investors confidence that resilience delivers returns.

By combining A&E expertise, advanced catastrophe modeling and de-risking financial partners like green banks, RDPs can generate investment-ready pipelines that satisfy both public-sector goals and private-sector due-diligence requirements. In addition to advancing more resilient design solutions, this approach structures improved resilience as an asset class that investors can underwrite, helping to shift adaptation from discretionary spending to core infrastructure financing.

The parametric-based projects above link risk to revenue to resilience—moving adaptation into mainstream infrastructure investment. To scale this model, we need projects that:

- Avoid losses through quantified disaster risk and insurance cost reductions.

- Deliver co-benefits like improved air quality and equity gains and a levelized cost of energy.

- Support ecosystem integrity by protecting biodiversity and natural capital.

- Meet investor goals and transparency expectations.

- Align with community values and social needs.

UC Merced's proposed geothermal and thermal infrastructure network will lower campus carbon emissions, provide a resilient source of power and help stabilize long-term energy costs.

What Comes Next

We're approaching a new climate infrastructure era requiring four critical approaches:

- Codify adaptation as infrastructure by treating nature-based and decentralized systems as eligible for core infrastructure funding.

- Fund predevelopment by covering planning, modeling, and community engagement costs.

- Align parametric risk tools with financial-performance standards in project planning.

- Bridge the gap between design and financial entities to show that properly priced adaptation projects deliver measurable financial and social returns.

The Future Is Already Here—We Just Need to Fund It

Adaptation is no longer an optional or a sunk cost; it's infrastructure that can be funded, scaled and designed to last. By combining credible risk data, sustainability-forward design and innovative financing, we can build climate-resilient and bankable systems.

SmithGroup's use of high-quality risk modeling and university campus work aren't just projects. They're prototypes of a climate-adaptive, financially viable, ecosystem-positive future. The question isn't whether we can afford this. It's whether we'll design for known risks and fund the future we want.

Katrina Kelly-Pitou is SmithGroup’s Director of Climate Change Adaptation and Economics. Stet Sanborn is the Director of Climate IMPACT – the firm’s Integrated, Multidisciplinary, Performance Analytics Climate-Impact Team.